Canada remains a dream destination for higher education, but tuition fees and living costs can be overwhelming. With tuition averaging CAD 20,000 – 45,000 per year and living expenses reaching CAD 15,000 – 20,000 annually, many students rely on loans. In 2025, the focus is on finding low-cost student loan providers that make education more affordable.

This guide explores the most affordable study loan providers in Canada (2025) and tips for borrowing smart.

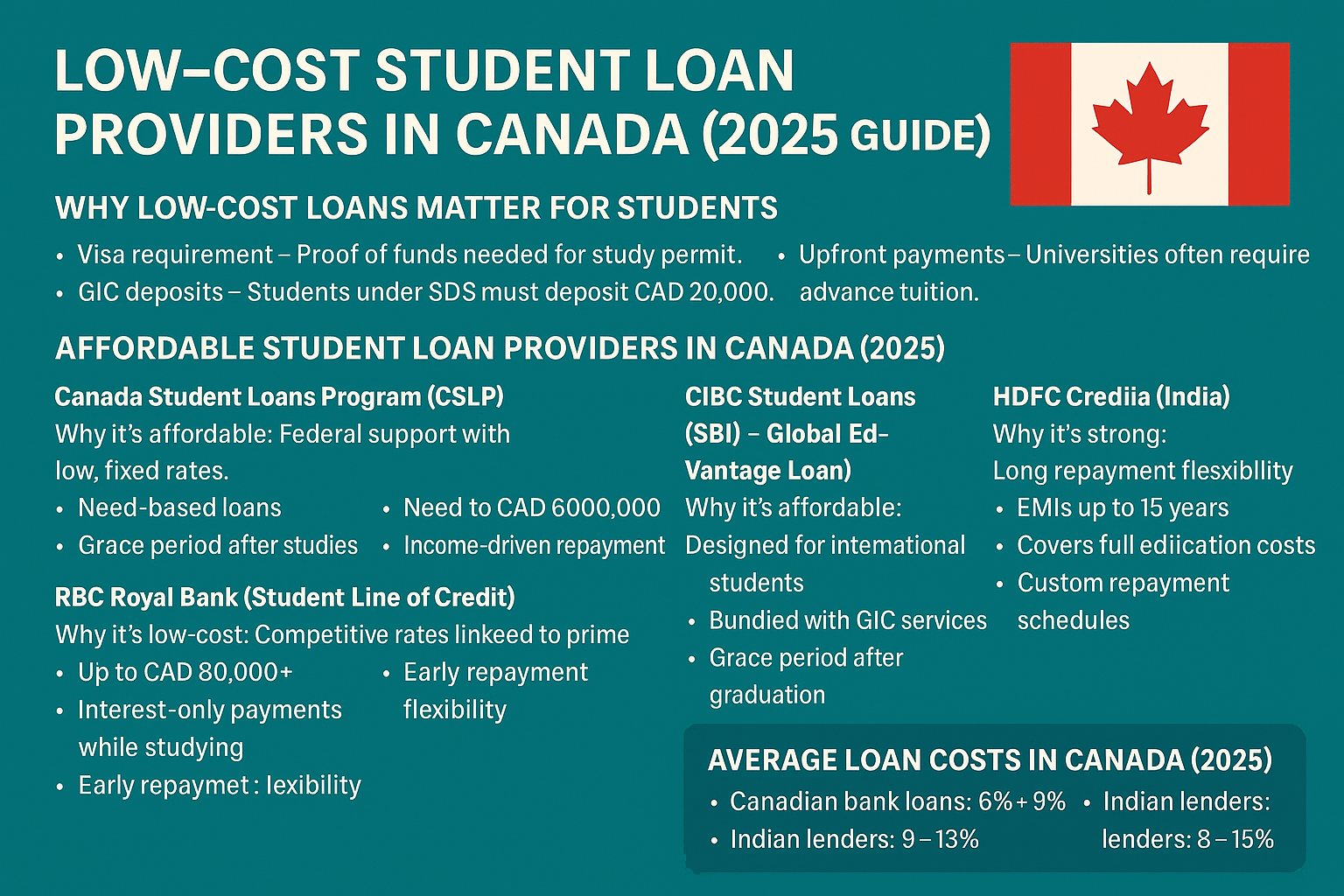

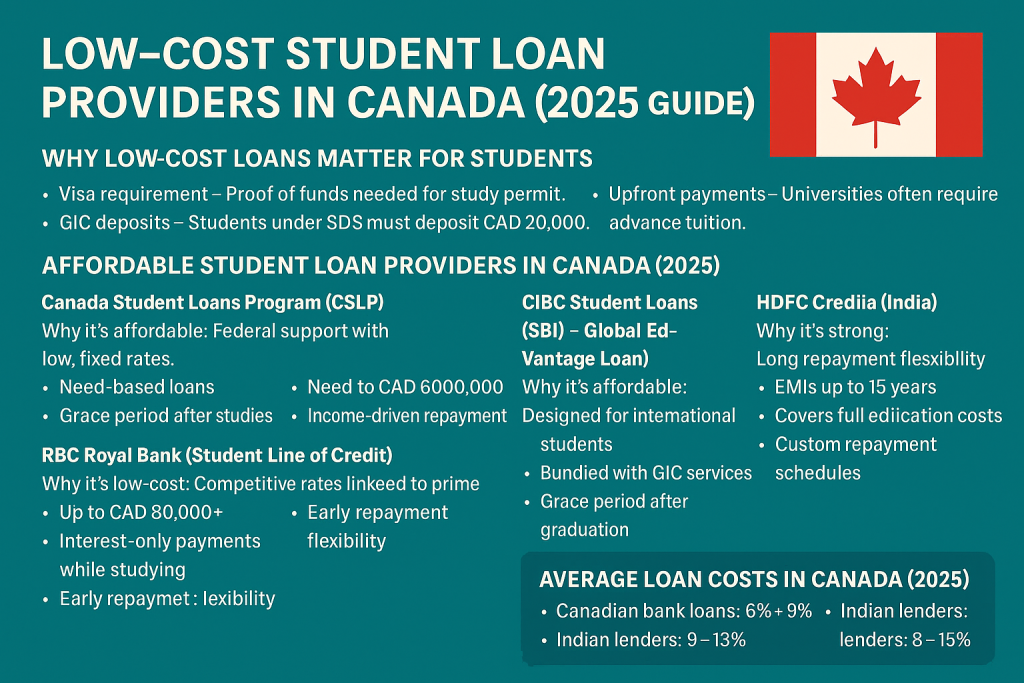

Why Low-Cost Loans Matter for Students

- Visa requirement – Proof of funds is needed for a study permit.

- GIC deposits – Students under SDS must deposit CAD 20,000.

- Upfront payments – Universities often require advance tuition.

- Debt management – Lower interest = easier repayment after graduation.

Affordable Student Loan Providers in Canada (2025)

1. Canada Student Loans Program (CSLP)

- Why it’s affordable: Federal support with low, fixed rates.

- Highlights:

- Need-based loans.

- Grace period after studies.

- Income-driven repayment options.

- Best for: Canadian citizens and PRs.

2. RBC Royal Bank (Student Line of Credit)

- Why it’s low-cost: Competitive rates linked to prime.

- Highlights:

- Up to CAD 80,000+.

- Interest-only payments while studying.

- Early repayment flexibility.

- Best for: Students with Canadian co-signers.

3. Scotiabank (Student Line of Credit + GIC)

- Why people choose it: Combines financing with visa support.

- Highlights:

- Multi-year approvals.

- Covers tuition + living.

- Linked to Student Direct Stream (SDS).

- Best for: International students needing visa support.

4. CIBC Student Loans

- Why it’s affordable: Designed for international students.

- Highlights:

- Bundled with GIC services.

- Grace period after graduation.

- Competitive repayment terms.

- Best for: International students needing one-stop banking.

5. State Bank of India (SBI) – Global Ed-Vantage Loan

- Why it’s affordable: Public bank with low interest.

- Highlights:

- Up to INR 1.5 crore for overseas study.

- Covers tuition, housing, and travel.

- Moratorium during study + 6 months.

- Best for: Indian students in Canada.

6. HDFC Credila (India)

- Why it’s strong: Long repayment flexibility.

- Highlights:

- EMIs up to 15 years.

- Covers full education costs.

- Custom repayment schedules.

- Best for: Students needing extended repayment.

7. Prodigy Finance (Global Lender)

- Why it’s unique: No guarantor or collateral needed.

- Highlights:

- Approval based on earning potential.

- Tuition + partial living covered.

- Graduate program focus.

- Best for: International students without co-signers.

Average Loan Costs in Canada (2025)

- Canadian bank loans: 6% – 9%.

- Indian lenders: 9% – 13%.

- International lenders: 8% – 15%.

- Repayment terms: 7 – 15 years.

💡 Example: A CAD 40,000 loan at 8% over 10 years = CAD ~485/month.

Tips for Securing Low-Cost Loans

- Apply early – 3–6 months before departure.

- Use co-signers – Canadian guarantors lower rates.

- Check university tie-ups – Some schools partner with banks.

- Borrow smart – Only take what you need.

- Compare globally – Home-country banks may be cheaper.

Final Thoughts

In 2025, students in Canada can find affordable loans by choosing wisely:

- CSLP for citizens/PRs.

- RBC, Scotiabank, and CIBC for local banking support.

- SBI and HDFC Credila for Indian students.

- Prodigy Finance for those without guarantors.

Affordable study loans keep Canadian education dreams alive without creating unmanageable debt.