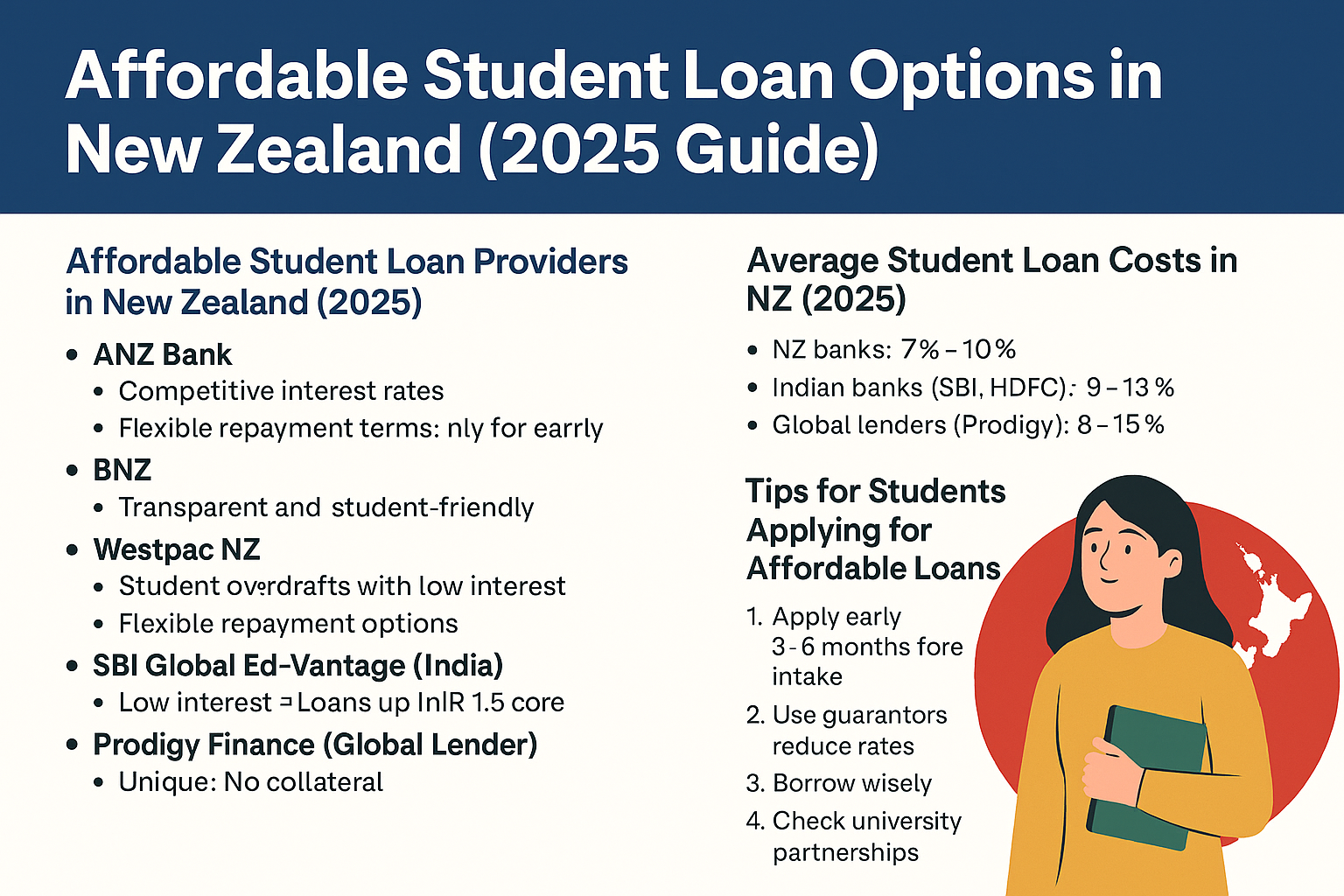

Affordable Student Loan Options in New Zealand (2025 Guide)

New Zealand is a top destination for international students, offering world-class universities and a safe, welcoming culture. But with tuition fees of NZD 22,000 – 40,000 per year and living costs around NZD 15,000 – 20,000 annually, many students rely on education loans. In 2025, the focus is on affordable student loan providers that keep … Read more