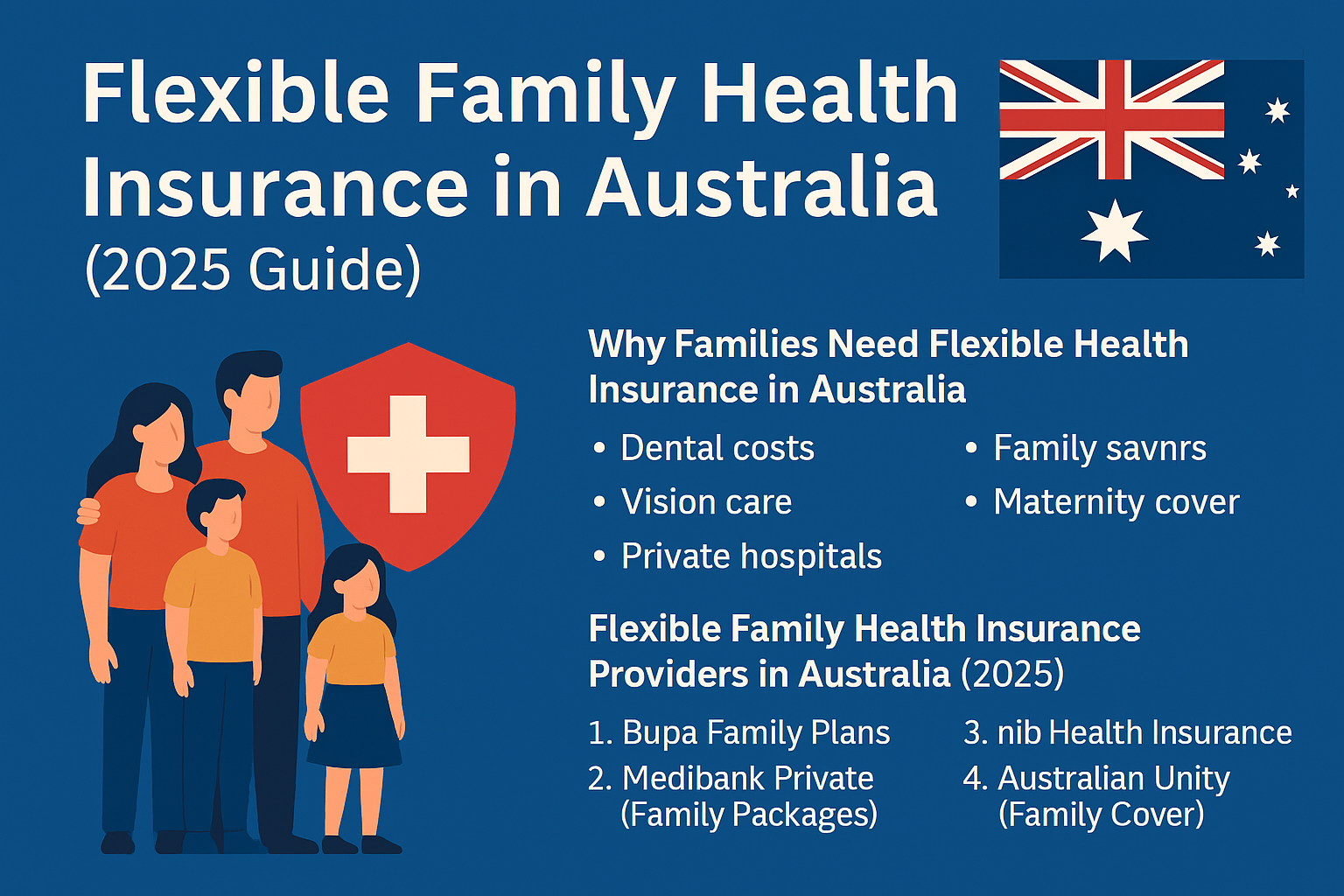

Flexible Family Health Insurance in Australia (2025 Guide)

Australia’s Medicare system provides a strong foundation for healthcare, but families often need private health insurance to fill the gaps. Dental, vision, maternity, and quicker access to private hospitals are key reasons parents invest in family-focused health insurance. In 2025, insurers are offering flexible family plans tailored to parents, kids, and even grandparents. This guide … Read more