New Zealand is a top destination for international students, offering world-class universities and a safe, welcoming culture. But with tuition fees of NZD 22,000 – 40,000 per year and living costs around NZD 15,000 – 20,000 annually, many students rely on education loans. In 2025, the focus is on affordable student loan providers that keep repayments manageable.

This guide highlights the most affordable study loan options in New Zealand (2025) and how students can borrow smartly.

Why Affordable Student Loans Matter in NZ

- Visa requirements – Proof of funds is mandatory.

- Upfront tuition costs – Most universities require pre-payment.

- Limited part-time work – Students can’t fully support themselves.

- Lower interest = easier repayment after graduation.

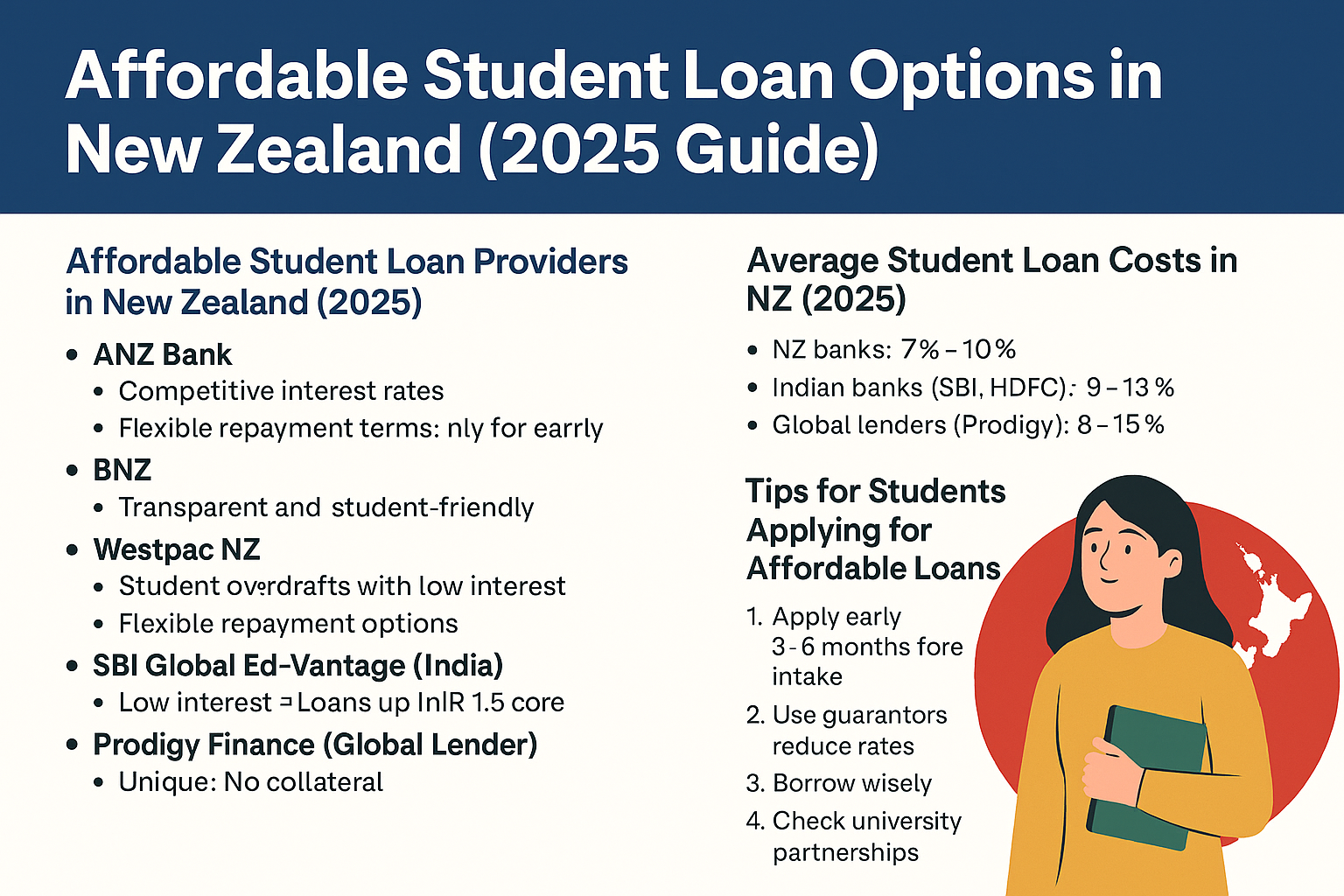

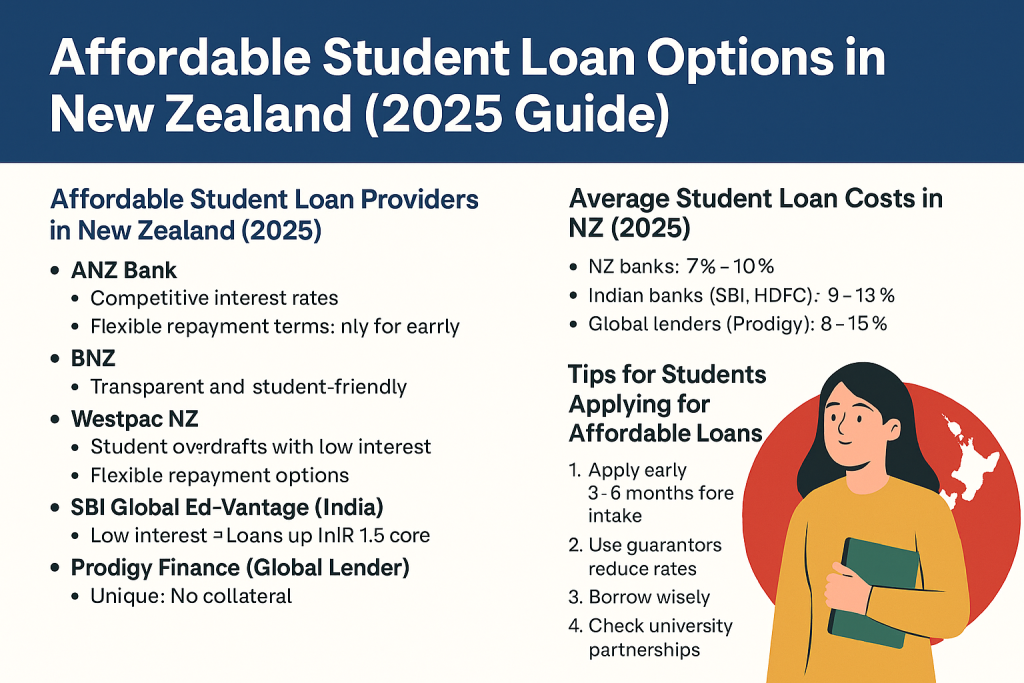

Affordable Student Loan Providers in New Zealand (2025)

1. ANZ Bank

- Why it’s affordable: Competitive interest rates.

- Highlights:

- Flexible repayment terms.

- No penalty for early repayment.

- Covers tuition and living.

- Best for: Students with guarantors in NZ.

2. BNZ (Bank of New Zealand)

- Why people choose it: Transparent and student-friendly.

- Highlights:

- Student overdrafts with low interest.

- Online loan calculators.

- Easy repayment flexibility.

- Best for: Students seeking smaller, budget loans.

3. Westpac NZ

- Why it’s solid: Longstanding bank with discounts.

- Highlights:

- Student discounts on repayments.

- Covers tuition + travel costs.

- Hardship support options.

- Best for: Families and long-term students.

4. ASB Bank

- Why it’s affordable: Low fees and online approval.

- Highlights:

- Quick digital process.

- Flexible repayment schedules.

- Transparent pricing.

- Best for: Tech-savvy students.

5. SBI Global Ed-Vantage (India)

- Why it’s affordable: Low interest compared to private lenders.

- Highlights:

- Loan up to INR 1.5 crore.

- Covers tuition, housing, and travel.

- Moratorium until 6 months post-study.

- Best for: Indian students applying from home.

6. HDFC Credila (India)

- Why it’s useful: Long repayment terms.

- Highlights:

- EMIs up to 15 years.

- Covers full study expenses.

- Custom repayment options.

- Best for: Students needing long-term affordability.

7. Prodigy Finance (Global Lender)

- Why it’s unique: No collateral required.

- Highlights:

- Approval based on future income.

- Covers tuition + partial living costs.

- For students from 150+ countries.

- Best for: International graduates without guarantors.

Average Student Loan Costs in NZ (2025)

- NZ Banks: 7% – 10%.

- Indian Banks (SBI, HDFC): 9% – 13%.

- Global lenders (Prodigy): 8% – 15%.

- Repayment terms: 5 – 15 years.

💡 Example: NZD 40,000 loan at 8% interest over 10 years = ~NZD 485/month.

Tips for Students Applying for Affordable Loans

- Start early – Apply 3–6 months before intake.

- Use guarantors – Local guarantors reduce rates.

- Borrow wisely – Only take what’s needed.

- Check university partnerships – Some schools have tie-ups with banks.

- Look for moratoriums – Repayment after studies eases pressure.

Final Thoughts

Affordable study loans in New Zealand help students pursue education without overwhelming debt.

- ANZ, BNZ, Westpac, and ASB are top local bank options.

- SBI and HDFC assist Indian students.

- Prodigy Finance is ideal for those without guarantors.

By comparing lenders and borrowing smartly, students can focus on studies while keeping finances under control.