Car insurance is mandatory in nearly every U.S. state, but costs vary widely depending on location, age, and driving history. With average annual premiums now around $1,600 – $2,200, many Americans are turning to budget-friendly insurers for reliable coverage at lower prices.

This guide highlights the most affordable car insurance providers in the U.S. (2025) and how to save money while staying protected.

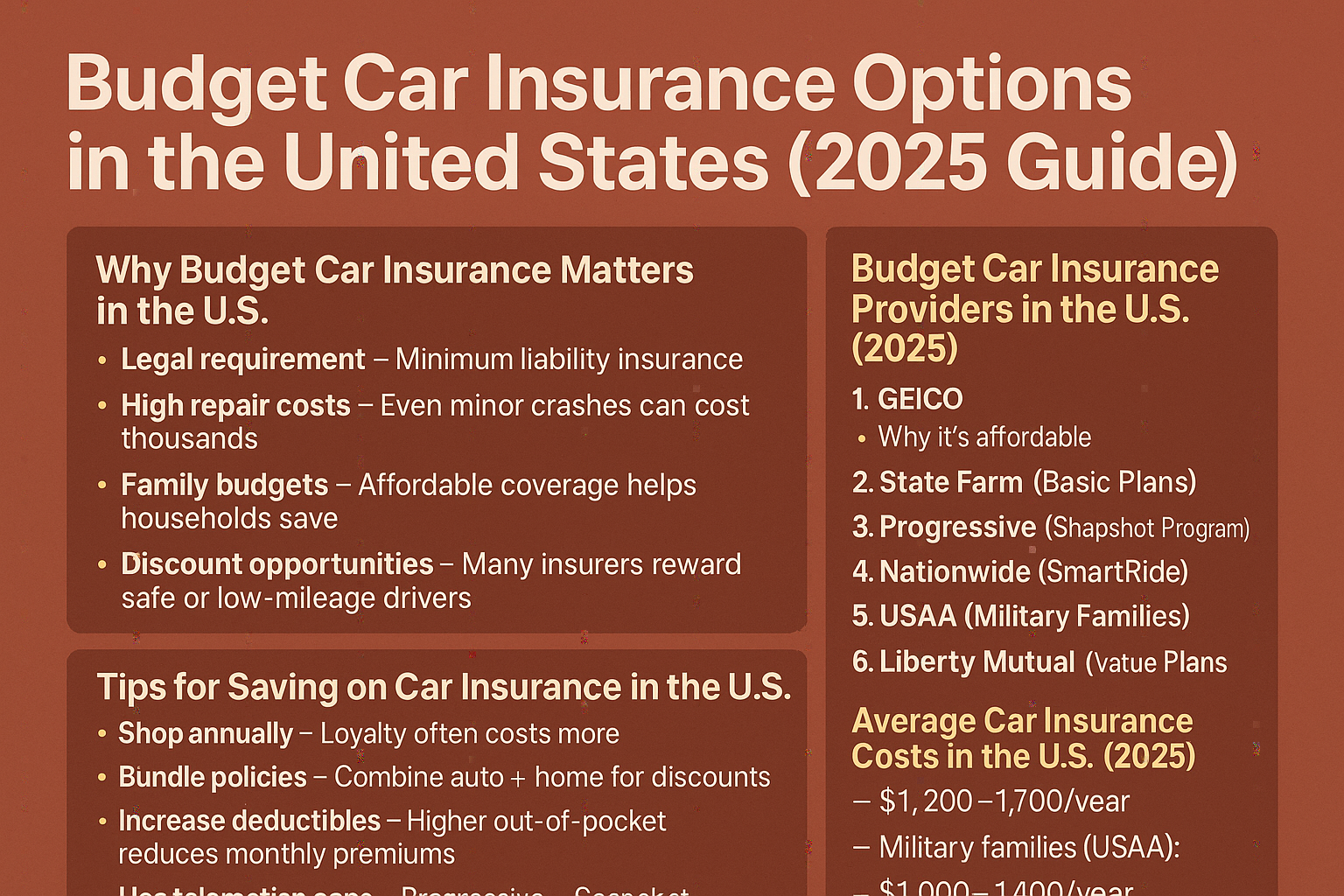

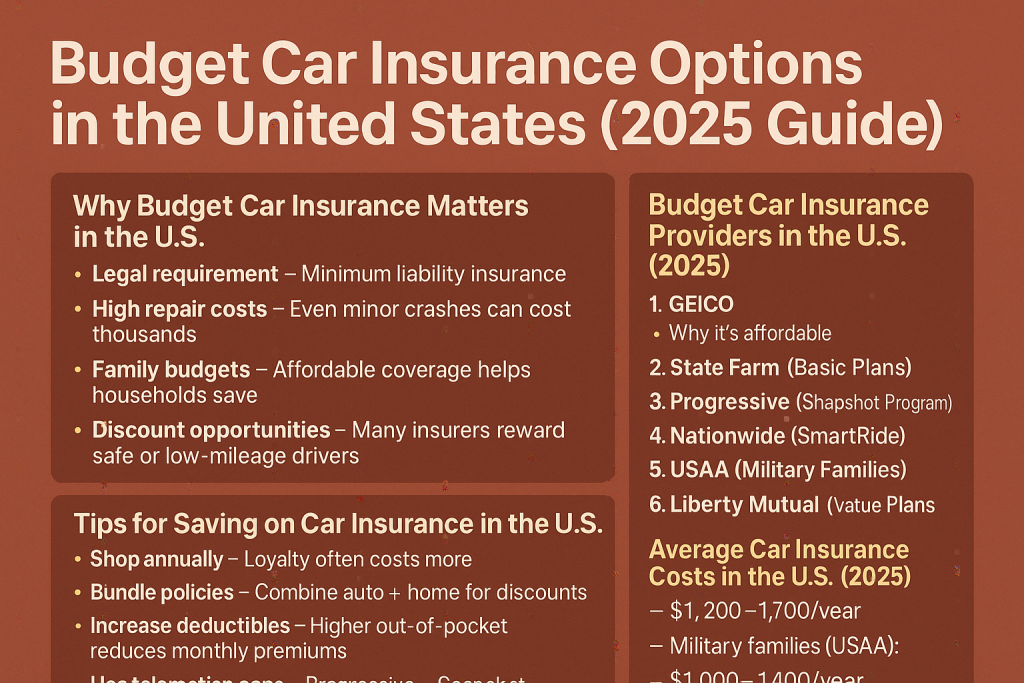

Why Budget Car Insurance Matters in the U.S.

- Legal requirement – Minimum liability insurance is mandatory.

- High repair costs – Even minor crashes can cost thousands.

- Family budgets – Affordable coverage helps households save.

- Discount opportunities – Many insurers reward safe or low-mileage drivers.

Budget Car Insurance Providers in the U.S. (2025)

1. GEICO

- Why it’s affordable: Consistently low premiums.

- Highlights:

- Discounts for safe drivers, students, and military.

- Strong mobile app for easy claims.

- Available in all 50 states.

- Best for: Budget-conscious drivers.

2. State Farm (Basic Plans)

- Why it’s trusted: Largest U.S. auto insurer.

- Highlights:

- Student and multi-policy discounts.

- Local agent support.

- Reliable claims service.

- Best for: Families needing personal assistance.

3. Progressive (Snapshot Program)

- Why it’s unique: Usage-based discounts.

- Highlights:

- “Name Your Price” tool fits coverage to budget.

- Snapshot app rewards safe driving.

- Good options for rideshare drivers.

- Best for: Tech-savvy and safe drivers.

4. Nationwide (SmartRide)

- Why it’s affordable: Discounts for safe drivers.

- Highlights:

- SmartRide telematics offers up to 40% savings.

- Bundling discounts with home/renters insurance.

- Affordable family policies.

- Best for: Safe households looking for extra savings.

5. USAA (Military Families)

- Why it’s unbeatable: Exclusive, lowest-cost coverage.

- Highlights:

- Available only to military members, veterans, and families.

- Consistently lowest premiums.

- Excellent customer satisfaction.

- Best for: Military families.

6. Liberty Mutual (Value Plans)

- Why it’s flexible: Customizable coverage at low cost.

- Highlights:

- “Better Car Replacement” option.

- Discounts for hybrid/electric vehicles.

- Student and family savings.

- Best for: Families needing flexible add-ons.

Average Car Insurance Costs in the U.S. (2025)

- Budget insurers (GEICO, Progressive, State Farm): $1,200 – $1,700/year.

- Military families (USAA): $1,000 – $1,400/year.

- High-cost states (FL, MI, NY): $2,500+/year.

- Low-cost states (ME, ID, OH): $1,000 – $1,400/year.

Tips for Saving on Car Insurance in the U.S.

- Shop annually – Loyalty often costs more.

- Bundle policies – Combine auto + home for discounts.

- Increase deductibles – Higher out-of-pocket reduces monthly premiums.

- Use telematics apps – Progressive Snapshot, Nationwide SmartRide, etc.

- Ask for discounts – Student, senior, and safe driver discounts cut costs.

Final Thoughts

Budget car insurance in the U.S. helps drivers stay protected without overspending.

- GEICO and Progressive lead in affordability.

- State Farm adds agent support.

- Nationwide SmartRide rewards safe drivers.

- USAA remains unbeatable for military families.

With smart shopping, drivers in 2025 can balance savings and coverage.