Personal loans are among the most widely used credit products in the U.S., helping people consolidate debt, pay medical bills, or cover big purchases. But in 2025, affordability is more important than ever, as borrowers seek low-interest personal loans with minimal fees.

This guide highlights affordable personal loan providers in the U.S. (2025) and tips for finding the right option.

Why Affordable Personal Loans Matter

- Debt consolidation – Replace high-interest credit card debt.

- Predictable payments – Fixed terms help with budgeting.

- Transparency – Affordable lenders avoid hidden fees.

- Financial relief – Lower APR = less stress over time.

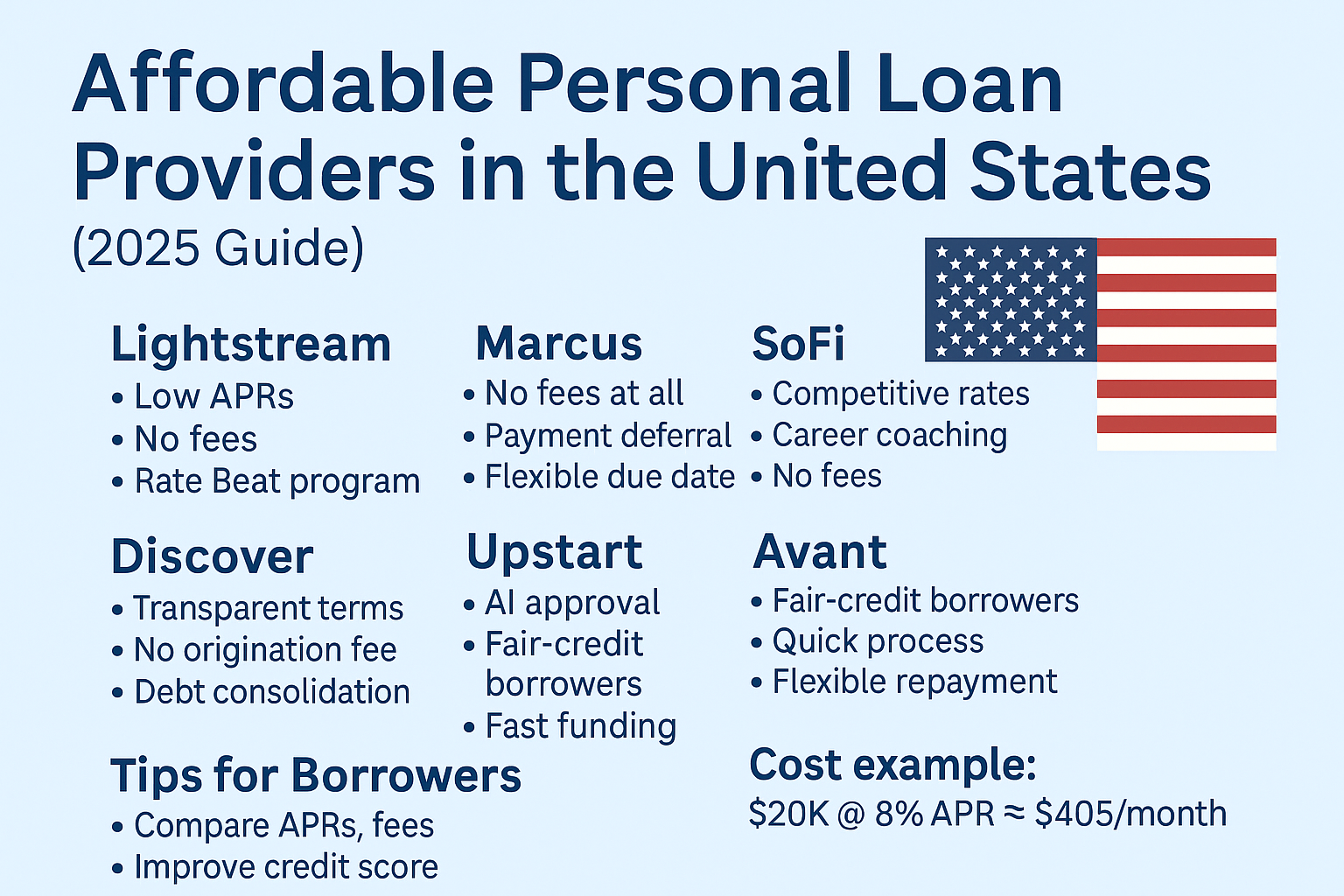

Affordable Personal Loan Providers in the U.S. (2025)

1. LightStream (Truist Bank)

- Why it’s affordable: Some of the lowest APRs available.

- Loan range: $5,000 – $100,000.

- Rates: Starting ~7%.

- Highlights:

- Rate Beat program.

- Same-day funding.

- No fees at all.

- Best for: Borrowers with excellent credit.

2. Marcus by Goldman Sachs

- Why it’s popular: Transparent, fee-free loans.

- Loan range: $3,500 – $40,000.

- Rates: 8% – 20% APR.

- Highlights:

- No origination or late fees.

- Payment deferral after 12 on-time payments.

- Flexible due date choice.

- Best for: Borrowers wanting clear, affordable terms.

3. SoFi Personal Loans

- Why people choose it: Competitive rates with added perks.

- Loan range: $5,000 – $100,000.

- Rates: ~8% APR and up.

- Highlights:

- Career coaching + financial planning.

- No fees.

- Unemployment protection (pause payments if job loss).

- Best for: Young professionals with strong credit.

4. Discover Personal Loans

- Why it’s affordable: Transparent and flexible.

- Loan range: $2,500 – $40,000.

- Rates: 7% – 20%.

- Highlights:

- No origination fees.

- Direct debt consolidation option.

- 30-day money-back guarantee.

- Best for: Borrowers consolidating debt.

5. Upstart

- Why it’s flexible: AI approval helps fair-credit borrowers.

- Loan range: $1,000 – $50,000.

- Rates: 9% – 25%.

- Highlights:

- Considers education & job history.

- Fast approvals.

- Good for thin or average credit history.

- Best for: Borrowers rejected by traditional banks.

6. Avant

- Why it’s inclusive: Works with fair-credit borrowers.

- Loan range: $2,000 – $35,000.

- Rates: 9% – 29%.

- Highlights:

- Flexible repayment schedules.

- Quick online process.

- Best for: Borrowers with average credit needing quick cash.

Average Personal Loan Costs in the U.S. (2025)

- Prime borrowers: 7% – 12% APR.

- Fair-credit borrowers: 14% – 28% APR.

- Repayment terms: 2 – 7 years.

💡 Example: $20,000 at 8% APR for 5 years = ~$405/month.

Tips for Borrowers Looking for Affordable Loans

- Compare APR, not just monthly payment.

- Avoid lenders with hidden fees.

- Check for no early repayment penalty.

- Use marketplaces (like LendingTree) for multiple offers.

- Improve credit score – better scores unlock lower rates.

Final Thoughts

Affordable personal loans in 2025 are widely available if you know where to look.

- LightStream and Marcus lead with no-fee, low-rate loans.

- SoFi adds career perks for professionals.

- Discover works well for debt consolidation.

- Upstart and Avant make borrowing accessible for fair-credit applicants.

By comparing lenders carefully, Americans can save thousands over the life of their loans.