Car insurance is one of the biggest financial responsibilities for Australian drivers. While comprehensive cover offers peace of mind, it often comes with high premiums. In 2025, many Australians are turning to affordable car insurance options that still provide reliable protection.

This guide explores affordable car insurance providers in Australia (2025) and practical tips for keeping premiums low.

Why Affordable Car Insurance Matters

- Legal requirement – Compulsory Third Party (CTP) insurance is mandatory.

- High repair costs – Even small accidents can cost thousands.

- Family expenses – Multi-car households need affordable coverage.

- Peace of mind – Affordable plans balance protection with savings.

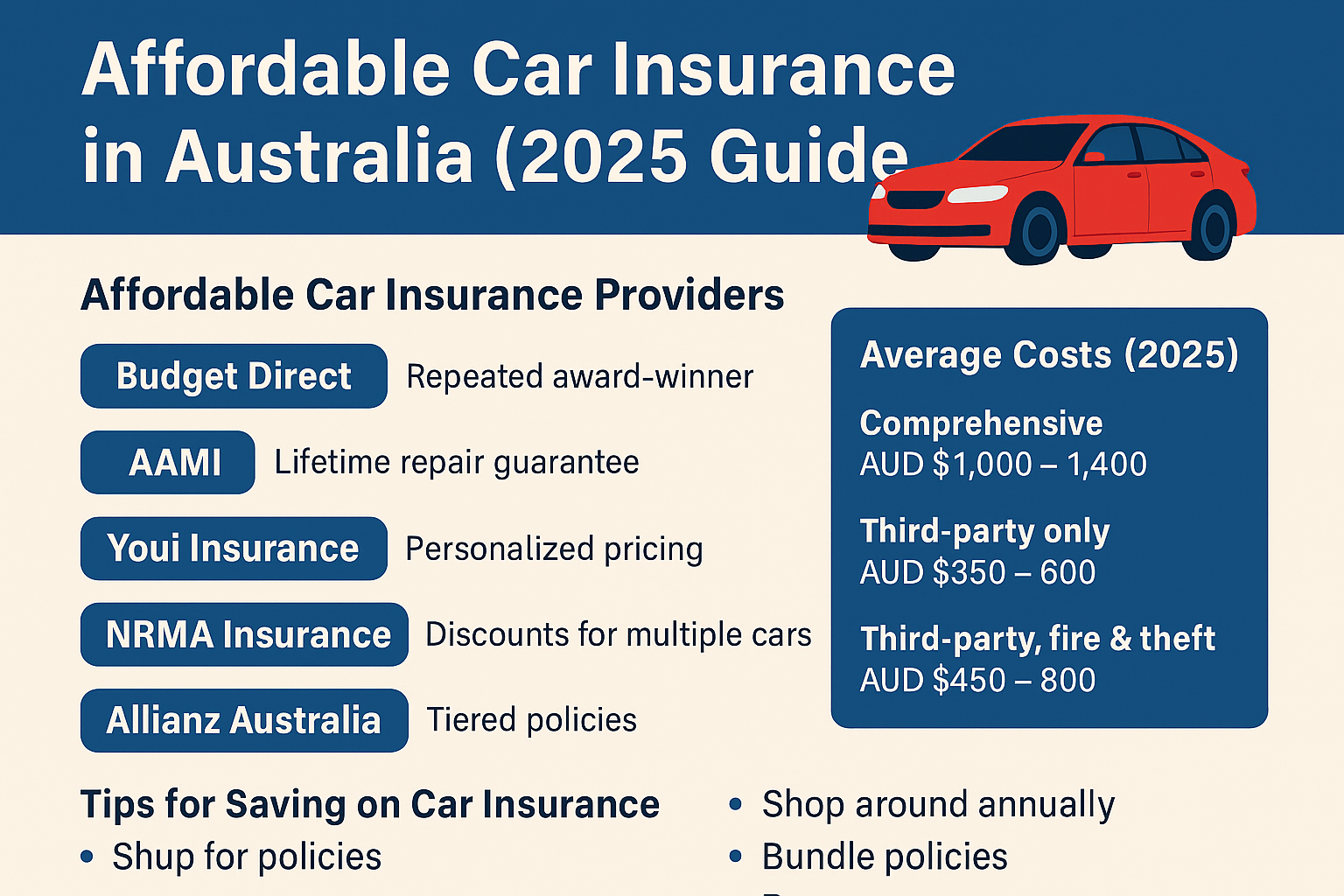

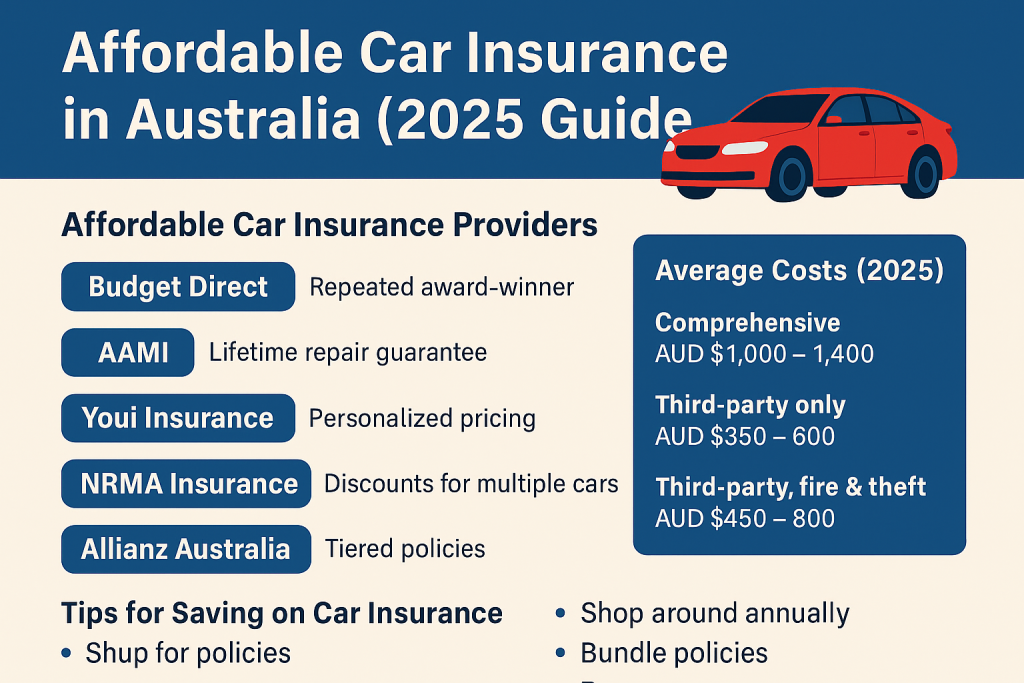

Affordable Car Insurance Providers in Australia (2025)

1. Budget Direct

- Why it’s popular: Repeated award-winner for affordability.

- Highlights:

- Consistently low premiums.

- 24/7 claims service.

- Safe driver discounts.

- Best for: Drivers prioritising budget savings.

2. AAMI

- Why people choose it: Trusted insurer with competitive entry-level policies.

- Highlights:

- Lifetime repair guarantee with approved repairers.

- Affordable third-party options.

- Discounts for long-term customers.

- Best for: Drivers who value brand trust.

3. Youi Insurance

- Why it’s unique: Personalised pricing.

- Highlights:

- Premiums based on actual driving habits.

- Cheaper for low-mileage drivers.

- Great customer service reputation.

- Best for: Drivers who don’t use their car daily.

4. NRMA Insurance

- Why it’s strong: Popular with families.

- Highlights:

- Discounts for multiple cars.

- Member benefits and roadside assistance.

- Flexible excess options.

- Best for: Families with multiple vehicles.

5. Allianz Australia

- Why it’s affordable: Tiered policies for different budgets.

- Highlights:

- Flexible comprehensive and third-party plans.

- Add-ons for roadside or rental cover.

- Bundling discounts with home/travel insurance.

- Best for: Households needing bundled policies.

Average Affordable Car Insurance Costs in Australia (2025)

- Comprehensive: AUD $1,000 – $1,400/year.

- Third-party only: AUD $350 – $600/year.

- Third-party, fire & theft: AUD $450 – $800/year.

💡 Young drivers pay higher premiums, but usage-based providers like Youi or safe driver programs help reduce costs.

Tips for Saving on Car Insurance in Australia

- Shop around annually – Compare insurers for better rates.

- Bundle policies – Add home/contents for discounts.

- Increase your excess – Pay a higher excess for lower premiums.

- Drive safely – Build a clean record for long-term savings.

- Consider third-party – For older cars, comprehensive may not be necessary.

Final Thoughts

Affordable car insurance in Australia is possible with the right choices.

- Budget Direct and AAMI offer trusted low-cost cover.

- Youi suits low-mileage drivers.

- NRMA helps multi-car families.

- Allianz provides flexible budget options.

By comparing quotes and tailoring coverage, Australians can stay protected in 2025 without overspending.